Best Accountants in Fort Worth, Texas

It’s a full time job to handle the accounting responsibilities for a business. But hiring someone full time is often cost-prohibitive. Of course there’s payroll, but then there’s insurance, training, trying to even FIND the right person…

It’s complicated.

So you take it on yourself.

But you’re not an accountant. You’re a Floral Shop Owner, a Restaurateur, a…something different than an accountant. So it’s likely you’re not trained to tackle all of the accounting responsibilities, and it’s even more likely that you don’t like it either. (If you did, you’d be a CPA!)

So you dread it. Try to rush through it…and end up making costly mistakes.

But we LOVE accounting!

And we do it every day.

We can do it efficiently, correctly, and cost-effectively.

Which leaves you time to handle the big-picture aspects of your business…the stuff that gets you excited.

Business Accounting Services in Fort Worth, TX

Payroll

Payroll, (and even payroll services!) can be a royal pain in the tookus. There’s the number crunching, and the taxes, and filing the correct state reports, (or risk costly penalties!) And while payroll services might be able to do it, most of the big ones are “a la carte.” (Which means they don’t necessarily provide everything you need. You need to ask for it, and you may not even KNOW what you need!)

So you start out thinking you’ll save yourself some time, but at the end of the quarter you realize you need that report…which you don’t have.

And what you do have…is a mess.

How do we know?

We’ve cleaned up a bunch of them.

So we are the best accounting firms in Fort Worth, TX that can help you! With our experience, we know exactly what you need to handle all your payroll challenges, stay compliant, and keep you and your employees happy!

Account Management

It seems simple at first…money comes in, money comes out. But it’s tedious and time consuming. And CATEGORIZING it gets tricky. Improper allocation can mean the difference of thousands of dollars overspent in taxes.

We know the ins and outs of proper charting of accounts and classification of transactions. So when it comes time to file taxes, you can be sure that the IRS won’t find anything to contest. And even if they do, you’ve got all the up to date reports to answer any questions that they might have.

Case Study

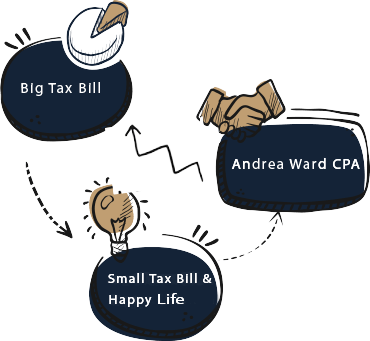

Dave was a self-employed health insurance agent with net income of $215,000 was going to pay $37,600 in taxes.

I recommended that he turn his business into an S-Corporation.

He set up a formal bookkeeping system, which cost $250 per month, and payroll services, which cost another $571 per year.

This investment, however, reduced his taxes from $37,600 to $22,188.

So, in the end, Dave saved $11,841!