Didn’t turn out to be such a great idea…

The Best Tax Preparation Services in Fort Worth, TX Pay for Themselves

Whether you are looking for self-employed or corporate tax preparation services in Fort Worth, TX, Andrea Ward CPA provides the best tax services in the Fort Worth, Texas area!

Personal Tax Services

Many of our clients thought that doing their own taxes was a good idea. They thought they’d crunch a few numbers, fill out a few forms, and save some money.

But you can get ALL the benefits of tax preparation services.

- Pay less in taxes because we know how to legally maximize deductions

- Increase your bottom line

- Save time that you can spend actually working on your business or with your friends and family

- Reduce the “brain-clutter” of tracking all those receipts and W2s

- Reduce the possibilities of a time-consuming and stressful IRS audit

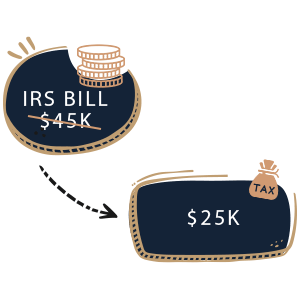

Case Study

One of our clients, Scott, had meticulously tracked his finances with Quickbooks.

Now Quickbooks is a fine program and allows a lot of flexibility in categorizing income and expenses.

However, Quickbooks and the IRS categories don’t always match up.

So Scott had originally recorded entries coming to $201,379 in net income…omitting a significant amount of legal deductions.

When we combed through his accounts, we corrected his net income to $146,386! (Since we’re accountants we’ll do that math for you…that’s a reduction in taxable income of $54,993!)

So, instead of owing the IRS $45,432 as he had calculated himself, he only had to pay $25,564.

He saved $19,868 in tax

Even with our fee he put an extra $16,268 in his pocket!

And he’s been with us ever since!

Rather than spending the time trying to track and organize financial data, or worry about overpaying, he focuses on enjoying the money we save him!

WE CAN HELP WITH

- Reducing your tax burden

- Creating a tax plan so there aren’t any surprises

- Increasing your business net profit

- Generating cash flow

- Establishing a line of credit

- Factoring receivables

- Prioritizing expenses

Business Tax Preparation Services

Our clients tell us they got into their business because they either enjoyed it or were good at it. (And ideally, both!)

But being a great landscaper, lawyer, or engineer doesn’t necessarily mean you are good at or enjoy preparing taxes.

But we ARE good at it, enjoy doing it well, and strive to be the best tax preparation in Fort Worth, TX.

Take tax preparation for your small business in Fort Worth, TX off your plate, and focus your energy on the big picture of growing your business. Leave the tedious details to us!

Case Study

Paul was a 50% owner of a trucking business operating as a partnership.

The business realized a net profit of $350,000, so his half of the profit was $175,000.

However, by transforming his ownership from being an “individual” into a C-Corporation, he was able to save $28,000 in tax.

So, through a simple restructuring, I helped the client save over $25,000!